THE STUDENT LOAN “BUBBLE”

March 14, 2015

The following post uses as references: Bloomberg Business, National Council on Higher Education, The Business Insider, and The College Board.

May 7 (Bloomberg) — A group of bankers that advises the Federal Reserve’s Board of Governors has warned that farmland prices are inflating “a bubble” and growth in student-loan debt has “parallels to the housing crisis. “Recent growth in student-loan debt, to nearly $1 trillion, now exceeds credit-card outstandings and has parallels to the housing crisis,” the council said in its Feb. 3, 2012, meeting. The trend has continued, with the Consumer Financial Protection Bureau saying in March 2012 that student debt had topped a record $1 trillion.

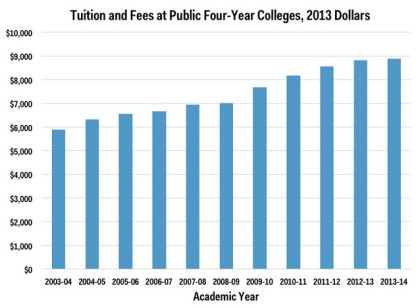

I was extremely surprised when first reading this statement published in Bloomberg Business. That surprise lasted about ten seconds. My wife and I put three boys through college; Mercer University, Tulane University and the University of Georgia. Even though they worked and had scholarships, the cost of a university education, even ten years ago, was daunting to a working engineer and his working wife. I can categorically state the cost of tuition for our three increased between three (3) and ten (10) percent each year depending upon the school. Have you purchased textbooks lately? Our youngest son had a book bill approaching $600.00 one semester. He was an undergraduate. Absolutely ridiculous. Of course this is not to mention lab fees, parking permits, mandated university health insurance and a host of other requirements the universities levied upon students and their parents. The chart below will indicate the increases by year. As you can see, these numbers are for public colleges.

The next chart will indicate tuition and total costs by region for two and four year colleges both public and private.

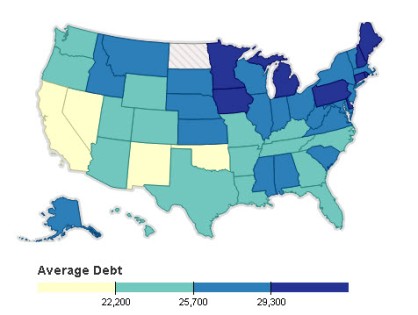

Seven in ten (10) seniors (69%) who graduated from public and nonprofit colleges in 2013 had student loan debt, with an average of $28,400 per borrower. This represents a two percent increase from the average debt of 2012 public and nonprofit graduates. The map below indicates graphically the problem by region.

The twenty (20) high-debt public colleges had an individual average debt levels ranging from $33,950 to $48,850, while the twenty (20) high-debt nonprofit colleges ranged from $41,750 to $71,350. Of the twenty (20) low-debt colleges listed, nine were public and eleven (11) were nonprofit schools, with reported average debt levels ranging between $2,250 and $11,200.

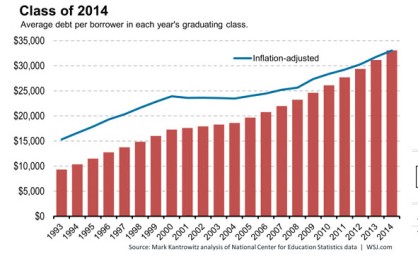

Let’s now congratulate the class of 2014. You now “enjoy” being the class with the most individual student debt in history. This comes at a time when job opportunities are at a minimum.

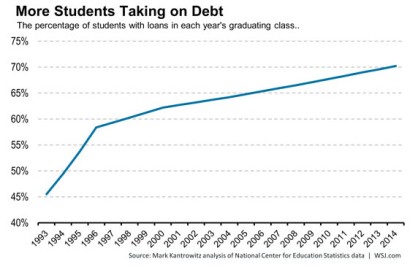

From the experience my wife and I had with our three boys, I’m not surprised at the following chart. As you can see, those who wish to obtain a college degree are sometimes forced to secure loans due to the extremely high tuition, book and living expenses. In looking at the graph below, we see that number approaching seventy percent (70%).

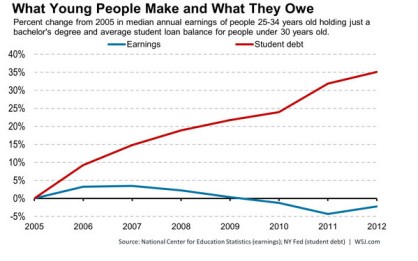

The next one is really scary. Take a look.

Student debt up approximately thirty-five percent (35%) and earned income down five percent (5%) from the year 2009.

One individual, in business, has recognized the gravity relative to this issue—Mr. Mark Cuban.

Mark Cuban states:

“It’s inevitable at some point there will be a cap on student loan guarantees. And when that happens you’re going to see a repeat of what we saw in the housing market: when easy credit for buying or flipping a house disappeared we saw a collapse in the price housing, and we’re going to see that same collapse in the price of student tuition, and that’s going to lead to colleges going out of business.”

I honestly believe Mr. Cuban is correct. Our economy either improves with significant increases in individual earning power or great issues with student debt will create a situation where smaller less prestigious colleges and even universities will have to close. The drop in enrollment will be significant. We have already experienced that in our town with two four year colleges closing.

OK, the big question. With the economy being in “the tank”, is a four year college degree worth it? Would it be better and with less stress to look at the “trades”?

- Plumber. The median salary for a plumber was $50,180 in 2013, the BLS reports. The best-paid pulled in about $86,120, while those in the bottom 10 percent earned $29,590 a year.

- Electrician Salary: $55,783 (average).

- Average Machinist Salary: $37,000.

- Auto Mechanic. The median annual salary for mechanic and automotive technicians was $36,710 in 2013. The highest earners in the field made about $61,210, while the lowest-paid took home $20,920.

- CAD Technician Salary: $47,966 (average)

Please don’t misunderstand, I have a four year degree in Engineering and love the profession. The university experience is wonderful and extremely rewarding, but maybe learning a trade and going to night school to obtain that four year degree is not such a bad idea after all. Even if it does mean an eight or ten year journey. If there is one thing I have learned in my seventy-two years: we have time. YES, there is time to do what you wish to do. You have to develop a plan, set realistic goals, stay focused and DO NOT GIVE UP.

I welcome your comments.

March 7, 2020 at 04:52

Hi there! I just want to offer you a huge thumbs up for your excellent information you have got right here on this post. I will be coming back to your site for more soon.

LikeLike

August 6, 2020 at 15:09

Hello Path. I’m very nervous concerning the student load bubble. I have two sons who still owe student loans so I get a first-hand look at the consequences of borrowing. Thank you for your very kind comments. I certainly hope you liked the content and found the post informative. I try hard to provide value-added for ones kind enough to read my posts. Take care and please come again. Bob.

LikeLike

July 14, 2017 at 10:25

Hi, Neat post. There’s a problem along with your site in internet explorer, may check this… IE still is the market leader and a huge portion of folks will pass over your great writing due to this problem.

LikeLike

July 14, 2017 at 17:42

Hello Dani. I really really try to post information that is value-added so my readers come away without feeling they waste their time. The “Student Loan Bubble” is very popular with my readers. Hope I’ve done that in your case. Take care.

LikeLike

May 21, 2015 at 04:18

Thanks a lot for the post.Much thanks again. Great.

LikeLike

July 9, 2015 at 17:49

Hello loanemu. The “Student Loan Bubble” is very very popular. I think I hit a nerve with this one. Thank you so much for your very kind words. I am certainly happy you took a look and hope you will return. I’ve been writing for about five years now–hopefully getting better at it. Take care. B.

LikeLike

May 20, 2015 at 10:02

I really like your blog.. very nice colors & theme. Did you create this website yourself or did you hire someone to do it for you? Plz answer back as I’m looking to construct my own blog and would like to find out where u got this from. thank you

LikeLike

July 9, 2015 at 17:50

Hello Edgar. I used the template furnished by WordPress. I chose the fonts and all of the colors but the template is theirs. I definitely recommend you start blogging. It certainly has been beneficial to me. Thank you so much for your very kind words. I am certainly happy you took a look and hope you will return. I’ve been writing for about five years now–hopefully getting better at it. Take care. B.

LikeLike